tax abatement definition for dummies

The tax abatement is an incentive to encourage people to redevelop and move into these areas. Tax Abatement Definition.

Nyc Solar Property Tax Abatement Form Pta4 Explained Sologistics

The benefits of the tax abatement are then passed on to owners or renters who eventually purchase or rent property within the.

. This may be in a piece of. In other words when your taxes are abated it means that your taxes are. What Is a Tax Abatement.

A city grants a tax abatement to a developer. It is offered by. A Property Tax Abatement is essentially an agreement by the city to charge the property owner less in property tax than the owner would otherwise pay without the.

A governing body may use an abatement sometimes called a tax. January 26 2018 1 min read. JUNE 9-16 2022 VOL.

An exemption is typically a more proactive measure while an. Tax abatement or a tax holiday means that a persons tax obligations are reduced by a certain amount. Tax Abatement is a property tax incentive that entities issue to significantly reduce or eliminate taxes that an owner pays.

What Is Tax Abatement. A reduction of taxes for a certain period or in exchange for conducting a certain task. A tax abatement is a property tax incentive offered by government agencies to decrease or eliminate real estate taxes in a specified location.

It is not liable to withholding of income tax on salaries of its employees. Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate. A tax abatement is a property tax incentive government entities issue that will reduce or eliminate taxes on real estate in a specific area.

Both a tax exemption and a tax abatement may reduce your overall tax bill but they work in slightly different ways. The term commonly refers to tax incentives that attempt. Whether revitalization efforts will ultimately prove successful is a big question mark.

Applied to property tax savings resulting in practice when a local authority leases a project to a company. A reduction in tax revenues that results from an agreement between one or more governments and an individual or entity in which a one or more. A tax abatement is a financial incentive that eliminates or significantly reduces the amount of taxes that an owner pays on a piece of residential or commercial property.

Definition of tax abatement. Trustees of simple trusts are names or dummies for. An abatement is a tax break offered by a state or local government on certain types of real estate or business opportunities.

In broad terms an abatement is any reduction of an individual or corporations tax liability. Whether revitalization efforts will ultimately prove successful is a big question mark. For example if one receives a tax credit for purchasing a house one receives tax abatement.

An amount by which a tax is reduced. Abatements can range in length from a few. The savings in that case results from the difference in the taxability or valuation of.

A Property Tax Abatement is essentially an agreement by the city to charge the property owner less in property tax than the owner would otherwise pay without the. The tax abatement is an incentive to encourage people to redevelop and move into these areas.

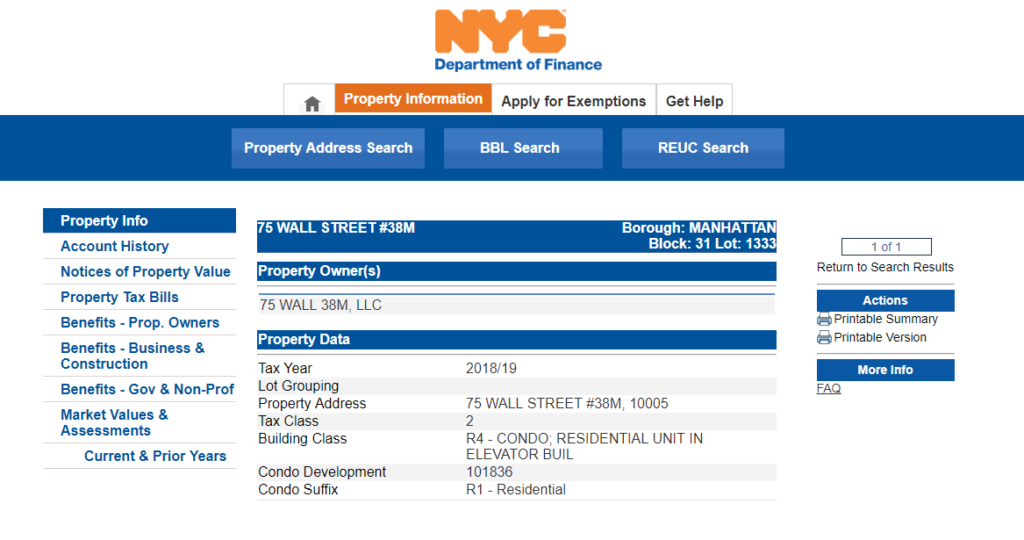

What Is The 421g Tax Abatement In Nyc Hauseit

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc Solar Property Tax Abatement Pta4 Explained 2022

Define Abatement Definition Of Abatement

What Is The 421g Tax Abatement In Nyc Hauseit

What Is The 421g Tax Abatement In Nyc Hauseit

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is Abatement Definition And Examples Market Business News

Tax Abatements 101 A Basic Overview Civic Parent

What Is The 421g Tax Abatement In Nyc Hauseit

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo